2025-12-15 12:19:51

102

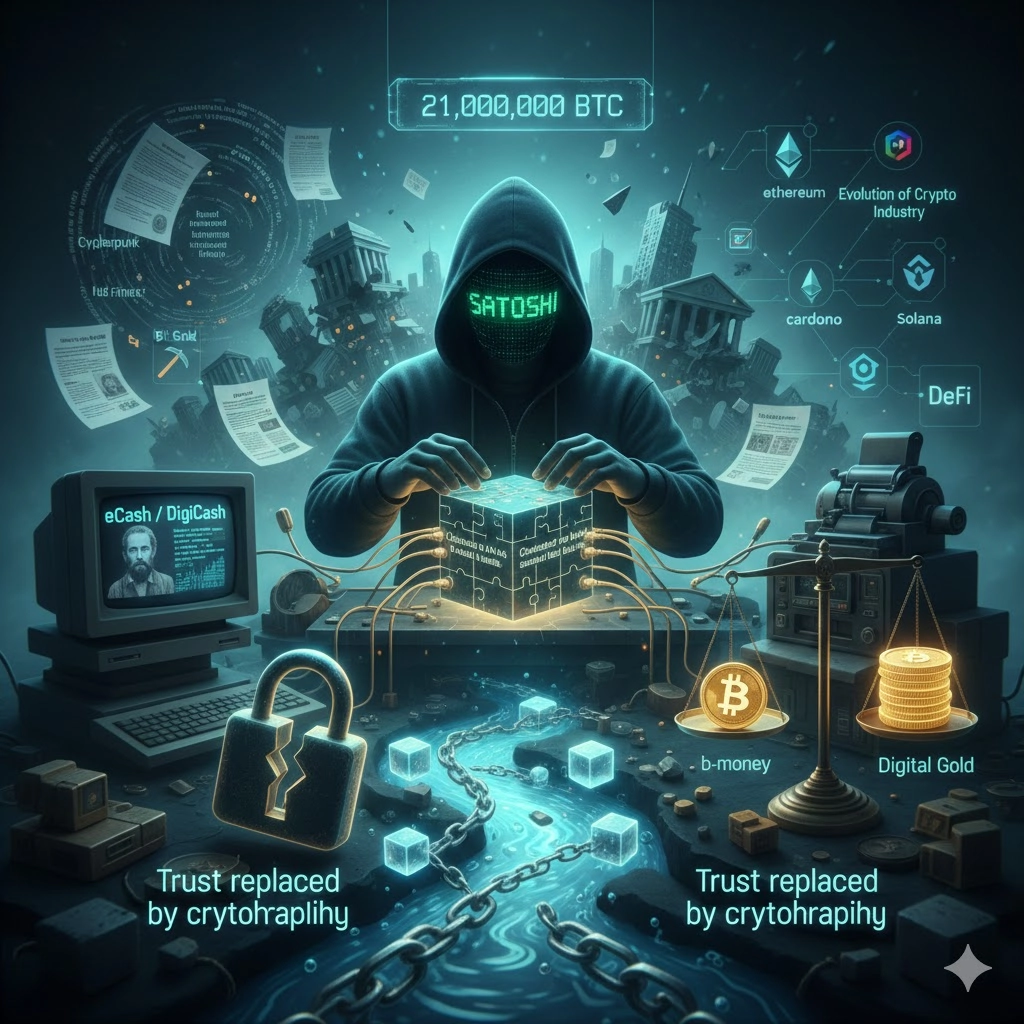

Today, cryptocurrencies represent a trillion-dollar market, a new financial ecosystem, a field of continuous innovation, and a subject of heated debate among politicians and economists. But long before the appearance of Bitcoin, there were dozens of ideas, projects, and bold experiments. The creation of cryptocurrency was not the inspiration of a single genius, but a long journey spanning over 30 years, where every setback became a building block for the future success of Bitcoin. To understand who truly invented cryptocurrency, one must trace this history from its roots—from the first electronic money in the 1980s to the emergence of the pseudonym Satoshi Nakamoto in 2008.

Long before Bitcoin, scientists, cryptographers, and enthusiasts tried to create electronic money that would allow payments to be made:

quickly,

securely,

without bank control,

without the risk of double-spending.

But the technology of the time was imperfect, and society was not ready. However, it was precisely these attempts that laid the groundwork for the emergence of Bitcoin.

The history of cryptocurrency begins not with Bitcoin, but with David Chaum—a cryptographer who, back in the 1980s, pondered how to protect financial privacy in the digital age. In 1983, he published "Blind Signatures for Untraceable Payments"—one of the first academic papers on digital cash. Based on these ideas, Chaum founded the company DigiCash in the 1990s and launched the first form of electronic money—eCash.

Key features of eCash:

digital banknotes signed by a bank,

the possibility of anonymous transactions,

protection against counterfeiting thanks to cryptography.

It seemed the world was ready for digital money. But there was a problem: DigiCash depended on banks and was itself a centralized company. When bankruptcy struck DigiCash, the idea of digital cash suffered a serious blow. However, Chaum's legacy became the foundation of the future crypto industry.

In the early 1990s, a group of programmers and encryption advocates known as cypherpunks took shape. Their goal was simple and radical: to protect human freedom through cryptography. Participants included Timothy May, Eric Hughes, John Gilmore, Adam Back, and Hal Finney—individuals who would later make huge contributions to Bitcoin. Their texts, such as the "Cypherpunk Manifesto," proclaimed:

freedom of speech and financial independence,

privacy protection as a fundamental right,

the necessity of tools independent of governments.

The cryptocurrency we use today was primarily forged here—in dozens of discussions, mailing lists, and early experiments.

In the late 1990s and early 2000s, projects emerged that came very close to the concept of cryptocurrency.

b-money (Wei Dai, 1998)

Wei Dai described a system with:

a decentralized ledger,

distributed transaction confirmation,

mechanisms for creating digital money,

autonomous contracts—a prototype for smart contracts.

But b-money remained theoretical—there was no software implementation.

Bit Gold (Nick Szabo, 1998–2005)

Szabo proposed the idea of:

a chain of proof-of-work,

a decentralized issuance model,

an immutable ledger.

Bit Gold is the closest "ancestor" of Bitcoin. But the project was never launched—it lacked the mechanisms for distributed consensus.

Hashcash (Adam Back, 1997)

Hashcash was created to fight spam—the sender of an email had to complete a computational task. The principle of Proof-of-Work—the core of Bitcoin's mining mechanism—originated here. Hashcash became a key element of the future Bitcoin architecture.

All these ideas were revolutionary, but none of the projects became a true digital currency. Why?

Lack of decentralized consensus

Centralization of the issuer

The "double-spending" problem

Lack of trust and technology

The first generation of digital money depended on companies (like DigiCash), meaning it could be:

shut down,

bankrupted,

prohibited.

All these mistakes and limitations became engineering clues for the person who, in 2008, would assemble the puzzle into a unified whole.

In the autumn of 2008, an event occurred that changed financial history forever. A message appeared in a cryptographer mailing list archive from an unknown author—Satoshi Nakamoto. Attached was a document that would, years later, be recognized as one of the most important texts of the 21st century.

On October 31, 2008, Nakamoto published the Bitcoin white paper—a nine-page document explaining:

how to create electronic money without a bank,

how to eliminate double-spending,

how to combine Hashcash, the blockchain, and distributed consensus,

how to build a network secured by mathematics, not authority.

The main idea of the white paper: trust can be replaced by cryptographic proof. At a time when the entire world was experiencing the 2008 financial crisis, this document became an intellectual protest against the weakness of the banking system.

On January 9, 2009, Satoshi launched the first version of Bitcoin. On January 3, he mined the genesis block (Block 0). Encrypted within it was a phrase from The Times newspaper:

"Chancellor on brink of second bailout for banks"

This was not just a message—it was a manifesto for the era:

the system is broken,

trust has been undermined,

a new solution is needed.

Satoshi sent the first transaction to Hal Finney—a legendary cryptographer and cypherpunk movement enthusiast. Bitcoin began its life.

Hal Finney was the first person to:

run the Bitcoin client,

receive a transaction from Satoshi,

actively test the network,

participate in code improvement.

Early participants alongside him included:

Adam Back—creator of Hashcash,

Wei Dai—author of b-money,

Nick Szabo—creator of Bit Gold,

developers and cryptographers from around the world.

It was a small but incredibly talented community that immediately grasped the magnitude of the idea.

Bitcoin became the first true cryptocurrency not because of a single discovery, but thanks to the combination of several breakthrough ideas:

Proof-of-Work + Blockchain = Double-Spending Protection

Pure Decentralization

Open Source Code

Unique Economic Model

Precision of the Engineering Solution

Bitcoin was not controlled by a company. There was no server. There was no regulatory center. The network lived on tens, then hundreds, and thousands of computers.

Anyone could:

download the code,

verify it,

improve the system,

join the network.

Issuance is strictly limited: 21,000,000 BTC. The rate of coin issuance decreases every four years—the halving occurs. This makes Bitcoin akin to digital gold. Bitcoin is not just an idea. It is:

strict cryptography,

stable algorithms,

mathematically precise parameters,

harmonious architecture.

Satoshi gathered the best elements of previous projects and created a system that is impossible to stop.

Satoshi Nakamoto is an almost mythological figure. He (or they) created the first fully functional cryptocurrency, rewrote the fundamentals of finance, and then disappeared without leaving a single verifiable trace. In the history of technology, this rarely happens. Therefore, the question "who invented cryptocurrency?" almost always turns into another:

"who is Satoshi Nakamoto?"

There are three main theories.

This is the most romanticized and popular hypothesis. According to it, Satoshi is:

a single mathematician or cryptographer,

brilliantly knowledgeable about distributed systems,

fluent in English at the level of technical academic writing,

possessing a deep understanding of economics, game theory, and computer security,

and at the same time, an incredibly disciplined, cautious, and ideologically consistent individual.

The style of the white paper supports this version: the text is short, clear, mathematically precise, meticulously crafted in a unified style—with no signs of collective work. The consistency of development also suggests a solo effort: Satoshi personally answered technical questions, quickly fixed bugs, intimately understood the structure of all components, and wrote the majority of the original code himself. But the problem is that the scope of knowledge embedded in Bitcoin is extremely rare for one person. Such universality is the exception, not the rule.

The second version suggests that Satoshi is a team. Possible variants:

a small group of cypherpunk participants,

a research team,

a pair of cryptographers and programmers,

a collective operating under a unified pseudonym.

Arguments in favor of this version:

1. Scale of Tasks

Bitcoin combines:

cryptography,

distributed computing,

an economic model,

network security,

resilience to attack strategies.

Highly specialized engineers typically lack expertise in all these fields simultaneously.

2. Perfect Implementation from the First Launch

Bitcoin's unique factor—it worked from day one. This is extremely unusual for a solo developer creating such a large-scale protocol.

3. Communication Style

It is:

dry,

strictly technical,

devoid of emotional outbursts,

without personal information.

This is often the writing style of a group rather than a single person.

Over the past 15 years, dozens of candidates have been put forward. But there are four figures most often linked to Satoshi.

1. Nick Szabo

Author of Bit Gold—the closest precursor to Bitcoin.

Arguments "for":

his project is maximally similar to Bitcoin,

his writing style and phrasing are close to the white paper,

he is a cryptographer, economist, and philosopher all at once,

he worked on the topic long before 2008.

Arguments "against":

Szabo has repeatedly denied his involvement,

his cryptographic ideas are still different.

2. Hal Finney

He was:

a network participant,

a miner,

the recipient of the first transaction.

Arguments "for":

he was a master of cryptography,

he created digital signatures and anonymous systems,

he had access to the cypherpunk mailing lists,

he lived near a person named Dorian Satoshi Nakamoto (a different person, often confused).

Arguments "against":

his correspondence with Satoshi appears genuine, not theatrical,

his death made confirmation or refutation of the hypothesis impossible.

3. Adam Back

Creator of Hashcash—the technology that became Bitcoin's foundation.

Arguments "for":

Hashcash is a key element of PoW,

he communicated with the cypherpunk community,

his writing style is partially similar.

Arguments "against":

he also denies his involvement,

Hashcash is only a part of the idea, not the complete prototype.

4. Craig Wright

An Australian entrepreneur who publicly claimed to be Satoshi.

Arguments "for":

the only person publicly claiming the role of Satoshi.

Arguments "against":

courts and the crypto community have not accepted his evidence,

he has never demonstrated the cryptographic signature (the key proof),

multiple contradictions in his story.

Today, Craig Wright is included in all lists as an unreliable candidate.

There are several fundamental reasons:

To avoid pressure from governments and corporations

To preserve the project's decentralization

To avoid a cult of personality

To protect personal security

The creator of digital money that undermines the banking system would become a target of:

surveillance,

legal prosecution,

pressure from special services.

If the identity were known:

he would become the "leader",

his words would be interpreted as the official stance,

the project would become dependent on one person.

Anonymity made Bitcoin truly ownerless and independent at the same time.

Bitcoin became the biggest innovation of the 21st century—but it's important to understand that some of its components were invented, while others were brilliantly combined. Satoshi did not create everything from scratch. He assembled a puzzle that no one before him could fully solve.

Bitcoin's main innovation is the synthesis of four technologies:

Blockchain

Proof-of-Work (PoW)

Decentralized Consensus

Cryptography

The idea of such structures appeared earlier, but they were implemented fully for the first time here.

Blockchain + PoW

Taken from Hashcash, but modified:

to protect not just against spam,

but also to prevent double spending.

Decentralized Consensus

Before Bitcoin, variations of distributed ledgers existed, but there was no single working mechanism for reconciling data among thousands of participants. Bitcoin first proposed:

fair competition among nodes,

rewards for securing the network,

an economically sustainable system.

Cryptography

ECDSA signatures, SHA-256 hashes, Merkle structures—all of this was known. But no one had linked it into one system. Satoshi used existing tools but connected them in a way that formed a new technology.

Bitcoin is not just a technological revolution, but a philosophical one. Before it, any digital currency required:

an administrator,

a guarantor,

a bank,

an auditor.

Bitcoin first showed that: trust can be replaced by mathematics and a distributed network. This is the foundation upon which later grew:

Ethereum,

DeFi,

NFTs,

Web3.

One of the most underrated elements of Bitcoin is the rigid limit on the number of coins. A total of 21 million BTC will ever be issued. This:

makes Bitcoin analogous to digital gold,

protects against inflation,

transforms it into a store of value,

provides a mathematically predictable model of monetary policy.

In a world where national currencies have been devalued for decades, Bitcoin's deflationary structure became a revolutionary economic experiment.

When Satoshi published Bitcoin, he did the most important thing: he released the source code into the public domain. This allowed:

After Bitcoin's launch, the world of digital money changed forever. What started as "electronic cash" turned into a global industry, a new financial architecture, and an entire technological culture. Hundreds of developers, engineers, and entrepreneurs took Satoshi's ideas and began creating their own solutions—sometimes copying, sometimes improving, and sometimes moving in new directions.

The first successors to Bitcoin were altcoins—alternative cryptocurrencies created by modifying part of the source code. The most famous:

Litecoin (2011)

Created by Charlie Lee as the "silver" to Bitcoin's "gold."

Differences:

faster blocks,

a different mining algorithm (Scrypt),

focus on everyday payments.

Litecoin showed that Bitcoin could be improved without destroying the basic idea.

Bitcoin Cash (2017)

A Bitcoin fork that emerged from a dispute over scaling. The main goal:

to increase the block size,

to make the network faster and cheaper.

Bitcoin Cash proved that the crypto community can split in decisive moments—and that conflictual decisions lead to the creation of new networks.

Other Altcoins

Dozens of projects attempted to:

change the mining algorithm,

make transactions more private (Monero, Zcash),

speed up confirmation times (Dash),

adapt Bitcoin for niche tasks.

But most of them have not achieved the popularity of the original BTC.

Bitcoin is digital money. Ethereum is digital infrastructure. In 2015, Vitalik Buterin launched Ethereum—a platform that, for the first time, allowed users to:

create smart contracts,

launch decentralized applications,

issue custom tokens.

A smart contract is a program on the blockchain that runs automatically and is not controlled by anyone. This idea opened the doors for:

DeFi (Decentralized Finance),

NFTs,

DAOs,

tokenization,

Web3 applications.

If Bitcoin is the revolution of money, Ethereum is the revolution of programmable money.

The subsequent waves of development led to the emergence of third-generation projects:

Cardano—Charles Hoskinson's project, based on scientific methodology. Focus: security, formal verification, academic approach.

Solana—A highly scalable platform: tens of thousands of transactions per second, low fees, emphasis on speed.

Ripple (XRP)—A system for bank and interbank cross-border payments. Focus: speed, partnerships, corporate solutions.

Each of them solves its own set of problems:

speed,

security,

corporate application,

scalability,

compatibility with traditional finance.

The crypto industry has become multi-layered—Bitcoin is no longer the only player, but it remains the original source.

Despite thousands of new coins and technologies, Bitcoin remains:

the most secure network in the world,

the most decentralized project,

the most resistant to censorship,

a digital asset with "rules that no one can change",

a singular object of global financial consensus.

Bitcoin is not a company, not a startup, and not a fund. It has no CEO, no marketing, no governing council. This is what makes it unique:

Bitcoin is the only digital system in the world without a central authority and without the ability to rewrite the rules retrospectively.

No other project replicates this combination of properties.

The history of cryptocurrency is shrouded in legends, erroneous assumptions, and outright myths. The reason is simple: it is difficult for people to accept that the greatest financial technology of the 21st century was created anonymously.

There are many loud but untenable hypotheses:

"Bitcoin was created by intelligence agencies"

"The project was developed by corporations"

"It's an experiment in population control"

"Bitcoin was funded by banks to test digital assets"

None of these theories:

are confirmed by facts,

are consistent with the cypherpunk ideology,

explain the open, anarchic, public nature of the project,

take into account the economic model, which is hostile to centralization.

Most conspiracy theories arose because it is easier for people to believe in a "secret intelligence project" than in the genius of an anonymous cryptographer.

Perhaps the main lesson from Bitcoin's history is that: it's not who invented it that matters, but how it works. If the creator's name were known:

he would be made a "leader",

his words could manipulate the market,

the project would lose its ideological purity and true independence.

Satoshi's disappearance was the final, and perhaps the most important, ideological act that cemented Bitcoin's decentralization, forcing the world to focus on the immutable code rather than the fallible individual.

The question "Who invented cryptocurrency?" cannot be answered with a single name. Bitcoin is a result of decades of cumulative work, academic research, and ideological fervor from the cypherpunk movement.

The true invention was the synthesis. Satoshi Nakamoto's genius lay not in inventing a new cryptographic tool, but in combining Hashcash's Proof-of-Work, Nick Szabo's Bit Gold concept, and the cypherpunk's radical desire for privacy and decentralization into a single, perfectly functional, and economically sound system that solved the double-spending problem without needing a central authority.

The real inventor of cryptocurrency is the collective knowledge of the cryptographic community, organized and perfected by the anonymous figure of Satoshi Nakamoto. The project's survival and growth are a testament to the power of open-source code and decentralized governance. By staying anonymous, the creator gave the world a gift of truly ownerless money.